How to Understand Your Check Stubs

When was the last time you’re examined your check stub?

If it has been awhile, consider it an investment in your financially organized future.

These forms provide you with vital information about your earnings, taxes, and withholdings, as well as additional points of interest.

The habit of looking at your check stubs can help you to better manage your finances and understand the money that you are earning and otherwise.

Read on to learn how to make reading your check stubs a breeze.

1. Earnings

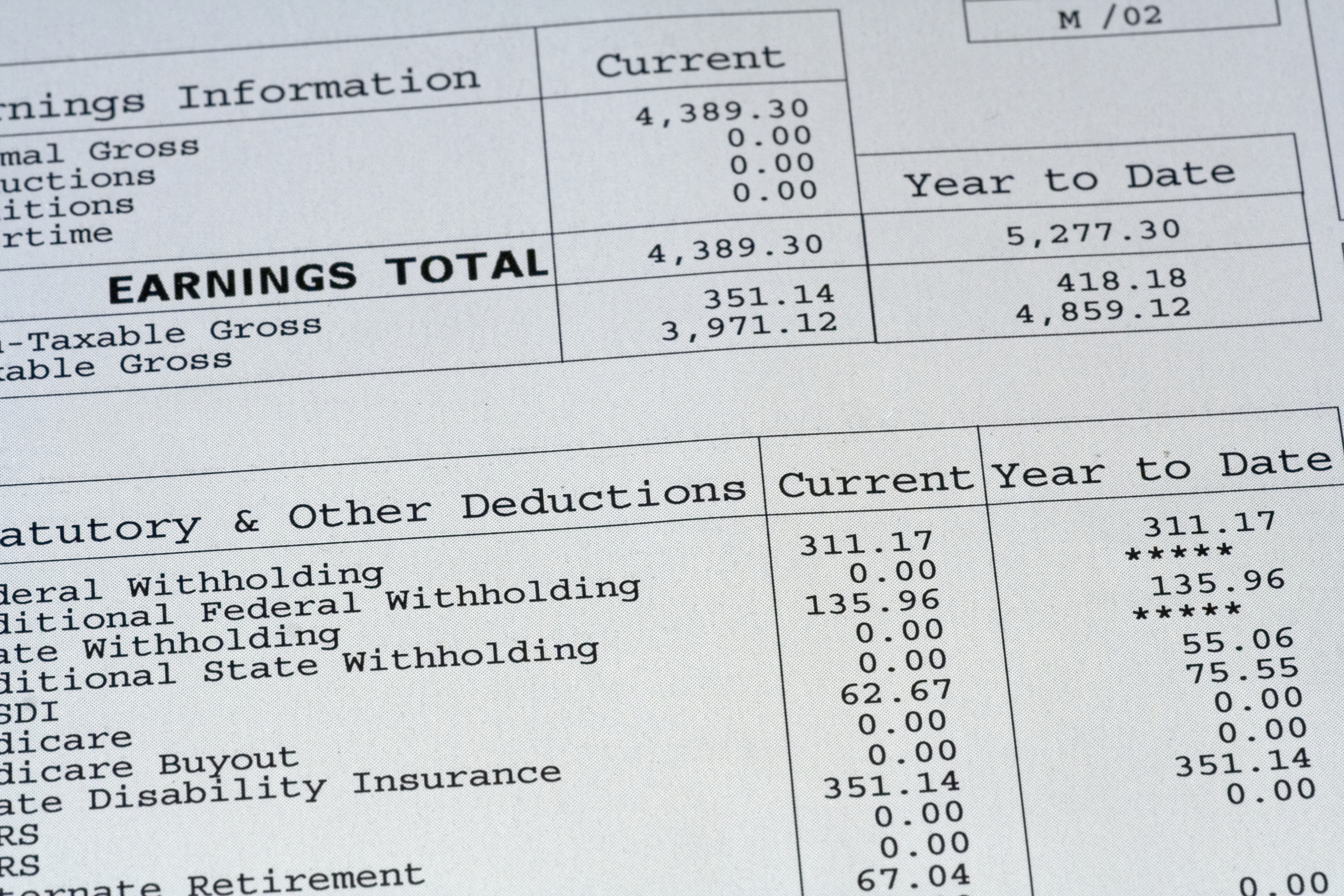

The first step is to check the earnings on the top of the paystub, which is vital to begin managing your finances. There should be your name, the name of your employer, their address, and the date of that the check was issued.

In the case of starting a new job, always double check that the information at the top is correct to avoid any future issues with human resources

Near the top should also be a box that states “Gross Pay”. This is the amount you earned prior to any taxes or withholdings. Keep in mind the pay period for the hours worked.

Next, look for the nearby box “Net Pay”. This is the amount that will take home after taxes and other withholdings are accounted for.

Confirm that these two sections at the beginning and end of the examination, to look for any discrepancies.

2. Taxes and Withholdings

The next step is to look for the amount that is removed from your gross pay that will be for taxes and other withholdings.

Start by looking for the statement “Federal Tax Amount”. This is the amount that is paid to the federal government for taxes, and it will vary based on any exemptions you made on your last W-4 form.

Nearby, there should also be a “State Tax” area. This is usually similar in amount to federal taxes, but it tends to vary from state-to-state. You can look into the amount that your state withholds.

Another important section is the term “Social Security”. Employees contribute 6.2% of their income to this fund that will be accessible to you in your older age. Employers will also contribute that amount in your name.

Lastly, there should be an area that says “Medicare”. This is the medical program that covers those who qualify for social security once they retire. This will be 1.45% of your earnings.

3. Additional Items

There are a few other items worth mentioning when exploring your check stubs.

The first is where it says “Year to Date”, which is usually towards the bottom. This will tell you exactly how much you have earned from that employer that year, as well as the amounts you’ve paid to taxes.

There are also other benefits that may be on your check stubs. These could include insurance deductions, retirement plans, and time off.

Moreover, if you find that your pay stubs are difficult to read, if not impossible, consider speaking with your HR department about The Paystubs. This service provides extremely easy to read stubs, which in turn will help the employees.

Importance of Check Stubs

These simple tips in reading your paystubs can help you budget and take control of your finances and have an in-depth knowledge of where your money is going.

This entire process can happen in a few minutes, and it can become quicker once you complete it a few times.

Remember to keep detailed records of our paystubs, paper or digitally. These are legal documents between your and your employer.

In the event that you are considering investing in a financial consultant to help you begin the journey of long-term financial security, check out our post on what to look for before you hire one.